travel nurse taxes allnurses

Our mission is to Empower Unite and Advance every nurse student and educator. Our mission is to Empower Unite and Advance every nurse student and educator.

If you get audited and you are accepting the free housing or housing stipend and are not paying rent back home or are just giving money to a family memberfriend and calling it rent you can kiss all your money.

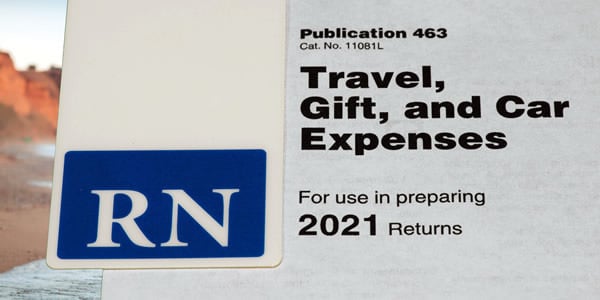

. Allnurses is a Nursing Career Support site. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. Travel nurse tax tips.

First your home state will tax all income earned everywhere regardless of source. Allnurses is a Nursing Career Support site. Since 1997 allnurses is trusted by nurses around the globe.

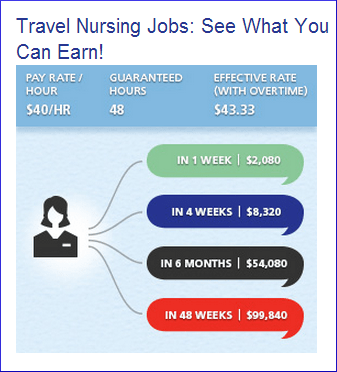

Travel Nurse No there is no restriction but for any travel contract you HAVE to be paying rent to someone and they have to be claiming it as rental income on their taxes. Since 1997 allnurses is trusted by nurses around the globe. This can vary greatly but the average income of a travel nurse including the stipends is 80k-90K per year.

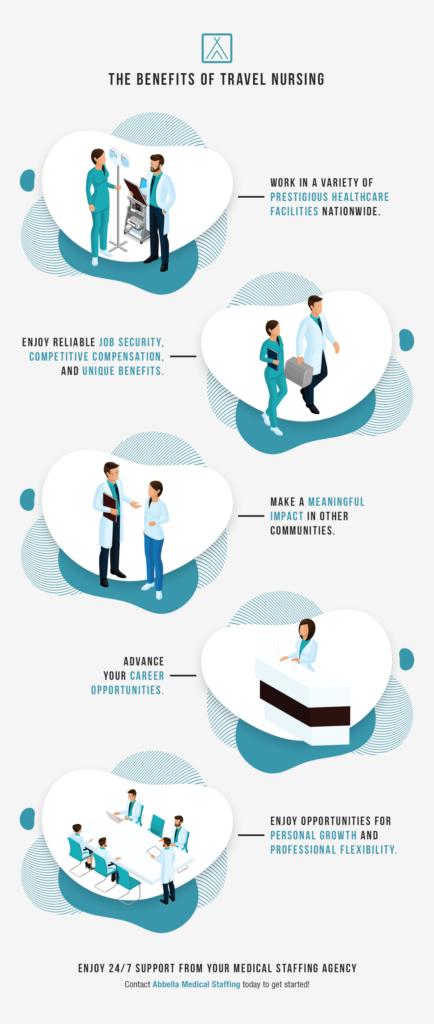

There are lots of travel nurses who travel and have their entire paycheck taxed and its also a wonderful way to have freedom and yes still make great money Travel nurses who earn tax-free money follow certain rules to be able to receive. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Establishing a Tax Home.

20 per hour taxable base rate that is reported to the IRS. Why Travel Nurses Are at a Higher Risk of Getting Audited. I could spend a long time on this but here is the 3-sentence definition.

At the same time the work state will. Smith says If theres a problem I get results whereas if people try to call themselves they wont get results. Therefore you need to look at the pay package as a whole when determining if it will fit your budget or not.

Here are my 17 Tips for a First Time Travel Nurse 17 Tips for a First Time Travel Nurse. Many states are still expecting residents to file by April 15th and still assessing penalties for those who file late. Be strict about your budget.

Allnurses is a Nursing Career Support site. He can deduct travel costs meals at 50 and lodging. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable.

Since 1997 allnurses is trusted by nurses around the globe. These too are typically calculated at 66 of your taxable weekly income. Just making more money as a travel nurse might sound ideal but studies have shown that the more specific your goal is the more likely you are to take real steps to achieve it.

Filing taxes for travel nurses are subject to different due dates. Travel nursing is a crazy exciting career path with a ton of benefits namely higher pay flexible schedules the freedom to travel all across this great country and way WAY more time off than most nurses. The site offers short and long-term home apartment or condo options.

The travel nurse pay breakdown can be calculated by dividing the 1500 in tax-free stipends by 36 the number of contracted hours per week the result is 4167 per hour worked. Our members represent more than 60 professional nursing specialties. FEDERAL AND STATE TAX.

Consider using a tax advisor. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Smith advises travel nurses keep a receipt book to help them make tax preparation a little easier by having all of their paperwork in one.

Our mission is to Empower Unite and Advance every nurse student and educator. Allnurses is a Nursing Career Support site. Two basic principles are at work here.

First travel nurses should consider the possibility of establishing and maintaining a tax-home so that they can qualify to receive the tax-free stipends. 1 A tax home is your main area not state of work. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses.

So set a very specific goal such as paying down 10K in debt or saving enough to take a month off to travel. Think salesman flying into some city for a couple of days. Our members represent more than 60 professional nursing specialties.

You can review this four part series 1 2 3 4 for detailed information on how to accomplish this. The majority of travel nurses could not afford to pay their full expenses at home and while on an assignment if they spend their entire stipend on housing and only take home the 25 after taxes and insurance. FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS.

Travel nurses can experience tax audits at a higher rate than other positions because of the high rate of nontaxable income compared to taxable income. FREE YEARLY TAX ORGANIZER WORKSHEET. Travel nursing income is not a traditional make a base pay get a W-2 position.

Our members represent more than 60 professional nursing specialties. If you are traveling away from home on business which is what most travel nurses do the IRS allows you to deduct expenses on your tax return. They protect your payment against fraud and a dedicated care.

Prior to COVID a travel nursing contract typically paid 1200- 2200 per week gross income. Since 1997 allnurses is trusted by nurses around the globe. Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other.

FREE YEARLY TAX ORGANIZER WORKSHEET. The same is true for Unemployment Payments. The fact that the income was not earned in the home state is irrelevant.

This means travel nurses can no longer deduct travel-related expenses such as food mileage gas and license fees and the only way to recuperate this money is either through a stipend from your travel agency or in the form of reimbursements for expenses you actually. Allnurses is a Nursing Career Support site. This is the most common Tax Questions of Travel Nurses we receive all year.

Not just at tax time. Our mission is to Empower Unite and Advance every nurse student and educator. Our members represent more than 60 professional nursing specialties.

VBRO is a very trusted housing site for travel nurses. Since 1997 allnurses is trusted by nurses around the globe. If you were able to successfully claim unemployment your unemployment payments would be very low.

Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your permanent tax home. VBRO is committed to user safety and comfort. Sep 2 2018.

The Ultimate Agency Management System for Travel Nurses Therapists and Techs. Like everyone else travel nurses pay tax on their income but the unique nature of travel nursing means its possible to lower your tax bill and keep more of your money in your pocket. Travel nurse tax tips.

Our members represent more than 60. I assume that those who believe they dont have a tax-home are harboring this belief because. During COVID travel nurses saw those rates go as high as 11000 per week for a 60-72 hour workweek in a crisis location.

Our mission is to Empower Unite and Advance every nurse student and. A tax advisor can be helpful in filing travel nurse taxes with everything from understanding the original contract to calling payroll offices and agencies. 20 per hour taxable base rate that is reported to the IRS.

Here is an example. Set a specific goal. As of April 2 34 states Washington DC and Puerto Rico are following the federal government and have extended the filing date to July 15 2020.

Nurses Tax Deductions Infographic Nurse Travel Nursing Nurse Midwife

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

How To Stop Travel Nurse Bullying Travel Nursing Nurse Healthcare Infographics

Report What It S Like To Be A Travel Nurse During A Pandemic

How Does Travel Nursing Work Trusted Nurse Staffing

It S Taxseason For Nurses Tax Deductions Are A Great Way To Improve Your Refund Check Out This Infogr Travel Nursing Nursing School Survival Nurse Life

The Traveler S I Ve Seen Add Yours General Nursing Support Stories Allnurses

Word Of Warning About Tax Consequences For Travel Nurses Travel Nursing Allnurses

How Much Do You Really Make As A Travel Nurse Travel Nursing Allnurses

5 Factors That Depress Travel Nursing Pay Rates Bluepipes

Travel Nursing Versus The Irs Irs Publication 463 Travel Nursing Allnurses

Travel Nurses Share Your Stories Travel Nursing Nurse Nurse Humor

Travelnurserecruiter Twitter Search Twitter

Travel Nurses Share Your Stories Travel Nursing Allnurses

Are Nurses Guilty Of Price Gouging For Being Paid 10 000 Per Week In Nyc Which Is Significantly Higher Than Normal American Enterprise Institute Aei

Report What It S Like To Be A Travel Nurse During A Pandemic

The Benefits Of Travel Nursing Learn More And Apply Abbella Medical Staffing

Travel Nursing Versus The Irs Irs Publication 463 Travel Nursing Allnurses